In an era dominated by online payments, Venmo, and digital wallets, it might seem like the good old-fashioned paper check is a thing of the past. But guess what? Millions of people in the United States still use checks every day — to pay rent, send gifts, make donations, or handle business payments.

If you’ve ever found yourself holding a blank check and wondering “Where do I even start?” — don’t worry, you’re not alone. Writing a check correctly isn’t hard once you understand the process. In this guide, I’ll show you exactly how to write a check step by step, explain what each part means, and help you avoid common mistakes that could delay your payments.

By the end, you’ll not only know how to fill out a check like a pro but also learn how to keep your finances safe and organized.

💡 Why People Still Use Checks

Despite digital banking, checks remain essential in many scenarios:

- Rent payments: Many landlords still prefer checks.

- Gifting money: A personal check adds a thoughtful touch.

- Paying small businesses: Local shops or service providers often accept checks.

- Business transactions: Companies still issue checks for vendors and employees.

- Record keeping: Checks provide a clear paper trail for your finances.

Knowing how to write a check properly ensures your payment is accepted, accurate, and traceable.

🧾 Step-by-Step: How to Write a Check Correctly

Let’s break down how to fill out each part of a check accurately.

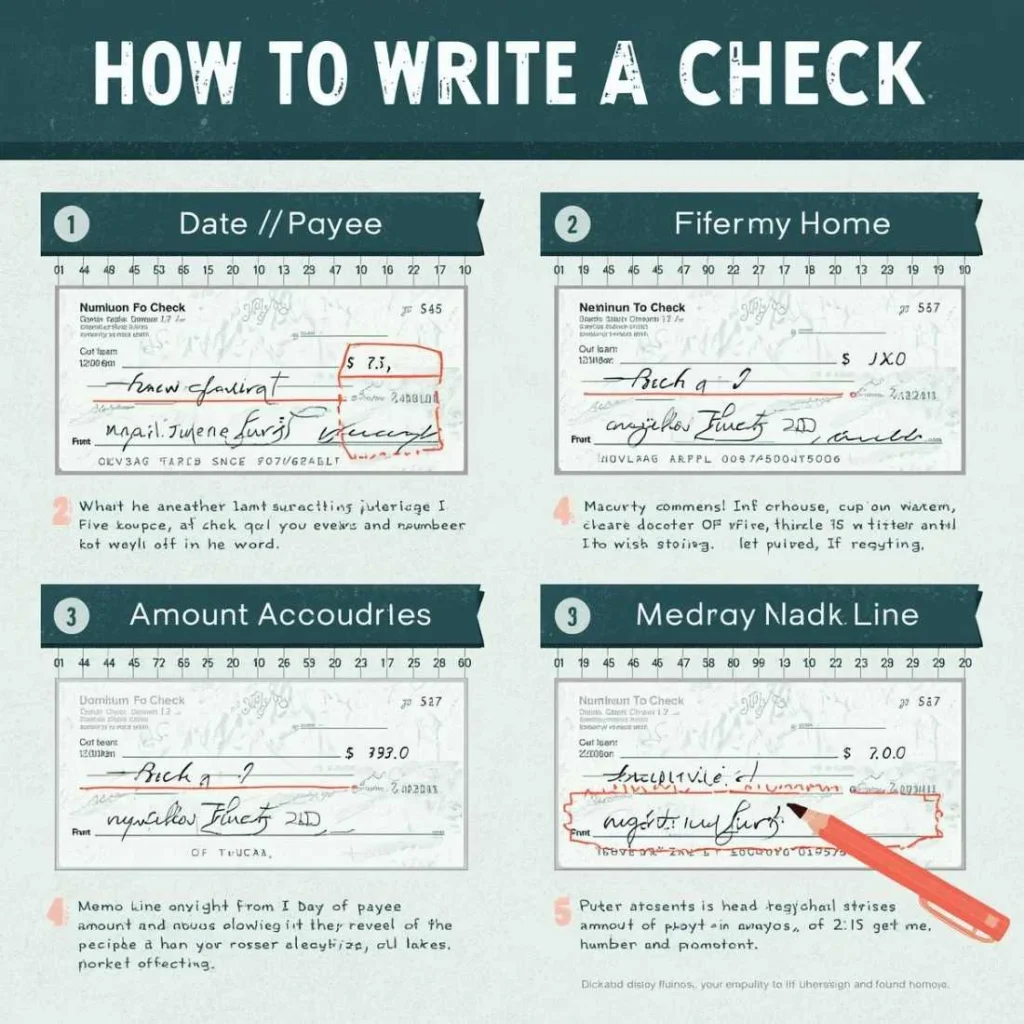

Step 1: Date Line (Top Right Corner)

Write the current date on the line at the top right corner. You can use the format:

- Month/Day/Year (e.g., October 17, 2025)

Tip: Never postdate a check (a future date) unless you have a specific reason and the recipient agrees, as many banks can process it immediately.

Step 2: Payee Line (“Pay to the Order of”)

Write the name of the person or company you’re paying.

Example:

- “Pay to the Order of: John D. Smith”

Pro tip: Always use the person’s full legal name or the company’s registered name to avoid deposit issues.

Step 3: Amount Box (Right Side)

In the box with the dollar sign $, write the exact amount of your payment in numbers.

Example:

- “$125.50”

Make sure your numbers are clear and legible — no smudges or extra spaces that could be altered.

Step 4: Amount in Words (Below Payee Line)

Write the amount in words to confirm the numerical value.

Example:

- “One hundred twenty-five and 50/100 dollars.”

If the cents portion is zero, write:

- “One hundred twenty-five and 00/100 dollars.”

Draw a line through any unused space to prevent tampering.

Step 5: Memo Line (Bottom Left Corner)

This section is optional but very helpful for record keeping.

Example:

- “October Rent” or “Gift for Sarah’s Graduation.”

It helps both you and the recipient know what the payment was for.

Step 6: Signature Line (Bottom Right Corner)

Finally, sign your name on the line at the bottom right.

Without your signature, the bank will not process the check. Make sure your signature matches the one on file with your bank.

🧮 Example of a Properly Filled Check

Imagine you’re paying your electric bill to “City Electric Co.” for $128.47 on October 17, 2025.

✅ Here’s how it should look:

- Date: October 17, 2025

- Pay to the Order of: City Electric Co.

- Amount Box: $128.47

- Amount in Words: One hundred twenty-eight and 47/100 dollars

- Memo: October Electric Bill

- Signature: (Your Name)

Simple, clean, and professional.

🔒 How to Keep Your Checks Secure

Writing checks safely is just as important as filling them out correctly.

1. Use a Permanent Ink Pen

Always write checks with a black or blue ink pen — never pencil. This prevents alteration.

2. Never Leave Blank Spaces

Fill out every line completely and draw lines through unused sections.

3. Record Every Transaction

Use your check register or mobile banking app to note:

- Check number

- Date

- Payee

- Amount

This helps you track your balance and prevents overdrafts.

4. Store Unused Checks Safely

Keep your checkbook in a secure place — not your car or desk.

5. Be Cautious with “Cash”

If you write “Pay to the order of: Cash,” anyone can cash it. Only do this when absolutely necessary.

💳 Common Mistakes to Avoid When Writing a Check

Even one small mistake can cause a check to bounce or get rejected. Avoid these pitfalls:

| Mistake | Why It’s a Problem | How to Fix It |

| Wrong date | May confuse banks | Always double-check before signing |

| Misspelled payee name | Recipient can’t deposit | Confirm spelling |

| Numbers don’t match words | Check becomes invalid | Ensure both match exactly |

| Forgetting your signature | Bank rejects check | Always sign before giving |

| Using pencil | Amount can be changed | Use ink only |

| Leaving spaces | Prone to fraud | Draw lines after your text |

🏦 How to Record Your Check Payments

Keeping a written record helps manage your budget and prevents overdrafts.

Option 1: Check Register

Your checkbook usually comes with a register. After writing a check, note:

- Date

- Check number

- Payee

- Amount

- Balance remaining

Option 2: Digital Tracking

Most modern banks allow you to view check images online. Some good options include:

- Chase.com

- BankofAmerica.com

- WellsFargo.com

Recording your checks helps you maintain control over your spending and prevents fraud.

📘 What Happens After You Write a Check?

Once your payee deposits your check, their bank sends it to your bank for verification and clearance.

- If funds are available: The payment goes through within 1–2 business days.

- If funds are insufficient: The check “bounces,” and you may face a NSF fee (Non-Sufficient Funds).

To avoid embarrassment or extra fees, always ensure you have enough money before writing a check.

💰 How to Void a Check Properly

If you make a mistake or need to cancel a check, you can void it:

- Write the word “VOID” across the front in large letters.

- Record the voided check in your register.

- Keep the voided check for your records.

You can also give a voided check to your employer for direct deposit setup.

🧠 Frequently Asked Questions (FAQs)

1. Can I write a check without money in my account?

No. The bank will reject the check due to insufficient funds, and you could face overdraft or legal penalties.

2. How to write a check for cash?

Write “Cash” in the Payee line. But remember, anyone can cash it, so use caution.

3. What if I make a mistake while writing a check?

If it’s small (like a misspelled word), draw a single line through it, correct it, and initial next to the correction. For bigger mistakes, void the check and write a new one.

4. Can I write a check on behalf of someone else?

Only if you have power of attorney or written authorization. Otherwise, it’s not valid.

5. How long does it take for a check to clear?

Usually within 1–3 business days, depending on your bank and the recipient’s bank.

6. How to stop payment on a check?

Contact your bank immediately. They can place a stop payment order, though there’s usually a fee for this service.

📊 The Future of Checks: Are They Going Away?

While electronic payments dominate, checks remain relevant for:

- Large or official payments

- Transactions requiring written authorization

- Businesses and older adults preferring traditional banking

According to the Federal Reserve, Americans still write over 3 billion checks annually, proving that paper checks aren’t disappearing anytime soon.

🖋️ Expert Tips for Writing Checks Like a Pro

- Write neatly and consistently.

- Use block letters if your handwriting is unclear.

- Always double-check your math.

- Keep extra checks in a safe, dry place.

- Never pre-sign blank checks.

If you ever doubt your process, resources like Investopedia’s Check Writing Guide can help refresh your memory.

📱 Digital Alternatives to Checks

Even though checks are reliable, it’s smart to know your digital options too:

- Zelle: Instant transfers between banks.

- PayPal & Venmo: Great for peer-to-peer payments.

- Online Bill Pay: Offered by most banks for recurring bills.

However, checks remain valuable for records, trust, and proof of payment — especially in business settings.

🎯 Conclusion: Mastering the Art of Writing a Check

Learning how to write a check may seem old-school, but it’s a vital life skill. Whether you’re paying bills, gifting money, or managing business expenses, understanding how checks work helps you stay financially confident and organized.

To recap:

- Always use ink and fill all lines clearly.

- Match written and numeric amounts.

- Sign and record every check.

- Protect blank checks from theft.